Investors

Invest in the future of electricity grids

Invest in the manufacturer of the future grid technology - efficent, lowest emissions and globally scalable.

The only market-ready alternative for the billion-dollar electric energy transmission market.

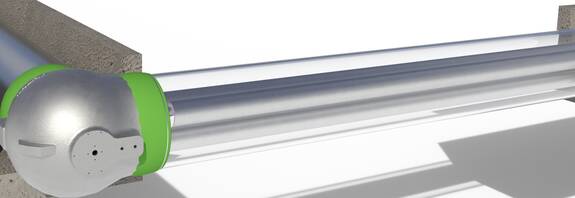

Patented pressurized air cable technology: highest transmission capacity, compact layouts, minimal energy losses – modern underground transmission.

Hivoduct is in a growth phase with a break-even foreseen within 24 months and the energy transition as a growth driver .

The current 2025 financing round has been successfully completed.

We would like to thank everyone involved for their trust.

Be part of the future of power grids

For companies and investors who recognize the potential of our unique, forward-looking technology and are interested in a strategic, long-term partnership, we continue to offer exclusive opportunities for participation.

Contact us directly to learn more about opportunities, prospects, and our joint path into a new era of innovation.

In conversation with our founder

Dr. Walter Holaus about motivation, vision and the role of investors in the energy transition.

"Private investors have the opportunity to actively participate in systemic change."

Find out what drives Walter Holaus personally here.

"We can no longer be satisfied with stopgap solutions."

Why now?

⚡ 70 % of power grids are outdated

🚫 EU ban on SF₆/PFAS from 2026

🏭 Production successfully launched

📈 Millions in orders already in the pipeline

💰 Break-even according to financial planning < 24 months